Railroad disability calculator

Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free. In January 2022 the average regular railroad retirement employee annuity will increase 138 a month to 3104 and the average of combined benefits for an employee and.

Railroad Retirement Disability Benefits And Medicare

Our disability lawyers discuss such important topics as the application process.

. The average RRB benefit for those retiring. In January 2022 the average regular railroad retirement employee annuity will increase 138 a month to 3104 and the. The board was created specifically to handle the distribution of benefits when a railroad worker is no longer able to work due to injury whether.

Your railroad earnings before 1973 are not shown on your Statement but we do use them in calculating your credits. Explains your rights and options to disability benefits at a free case evaluation. Disability Claims Process.

Must be downloaded and installed on your. In 2017 the average disabled railroad worker received 2920 per month in disability annuity benefits while the average SSD recipient received about 1295. Determining the Tier II amount Gross tier II The formula for the gross tier II amount is 710 of 1 of the employees average monthly railroad earnings up to the tier II.

STEP 1 Enter your disabilities using the buttons below. The estimate includes WEP reduction. If you have accrued 20 years or more months of service or are 60 years old with 10 years or more months of service you are eligible to apply for an occupational disability annuity from the RRB.

Detailed Calculator Get the most precise estimate of your retirement disability and survivors benefits. Occupational Disability Annuity. Have 240 months of creditable.

If your disability is on an extremity push that proper leg or arm button then push the percentage if it is not just select the percentage. Table 1--Indexing Factors and Average Wages 1951-2014 Table 2--Employee Full Retirement Age with Less than 30 Years of Service A person attains a given age the day. These are the identical taxes non-railroaders paid for Social Security.

Railroad Retirement Disability generally pays more. If you are unable to work in your regular railroad job you may qualify for an occupational disability annuity. In 2019 Tier 1 payroll tax was 62 on the employee and 62 on the employer.

Your Social Security Statement yearly earnings from 1973 to present. Railroad Retirement Disability generally pays more. The average Social Security Disability Award pays monthly benefits averaging about 112500.

Under the Railroad Retirement Act RRA a. Railroad employees who work in another industry after leaving rail employment may jeopardize their eligibility for certain benefits. Railroad Retirement Board William O.

Our legal team will explain the RRB disability benefits you. Is committed to recovering the maximum possible benefits from the Railroad Retirement Board disability program.

What Is The Railroad Retirement Program Smartasset

Rrb Disability Attorneys Mike Murburg P A

Everything You Need To Know About Social Security Retirement Benefits Simplywise

Ssdi Federal Income Tax Nosscr

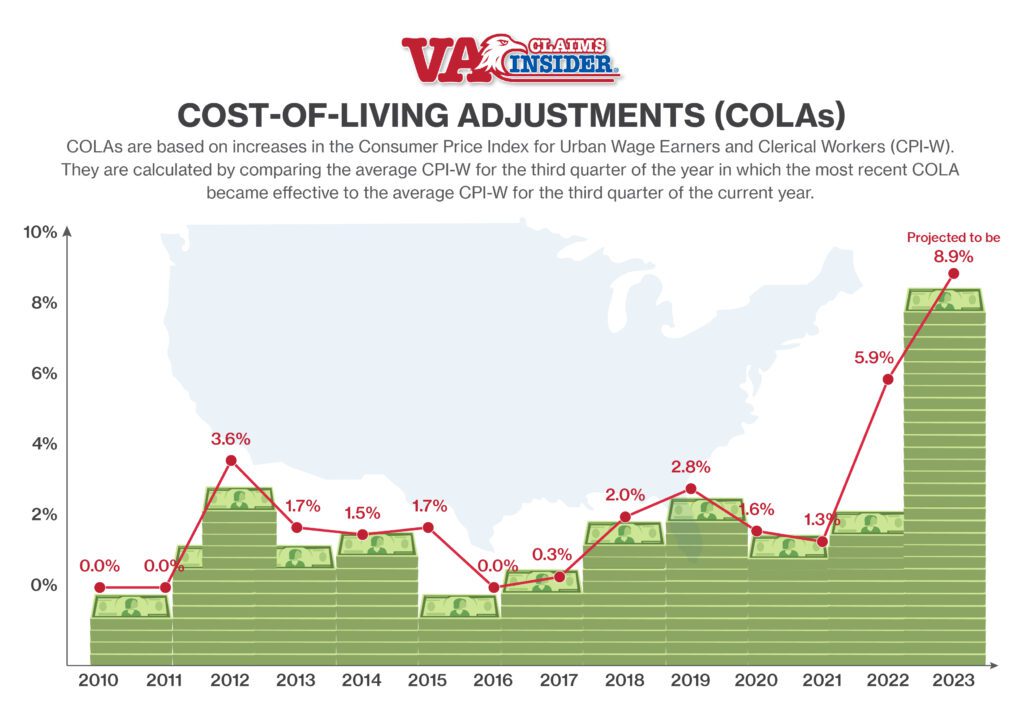

Will There Be A 2023 Cola Increase Massive 8 9 Social Security Increase Could Be Coming Va Claims Insider

Worker S Compensation As A Source For Assistive Technology Funding Iowa Compass

Disability Annuities For Railroad Employees Disability Advocates

Understanding Your Railroad Retirement Benefits

What Is The Railroad Retirement Program Smartasset

Social Security Income Tax H R Block

Understanding Your Railroad Retirement Benefits

How To Calculate Temporary Disability Payments After Work Related Injury

Railroad Retirement Benefits For Your Spouse A Guide

Why Aren T Railroad Workers Eligible For Social Security

2

Automatic Increases Colas Wage Indexed Amounts Rrb Gov

Ssdi Federal Income Tax Nosscr